Groww Lumpsum Calculator: Simplifying Future Value Projections for Investors

In today’s fast-moving investment world, having clear insights can make all the difference between holding back and jumping in. Younger folks like millennials and Gen Z love straightforward, tech-savvy tools that make handling money a breeze. Among India’s top fintech apps, Groww Lumpsum Calculator has become a go-to for mutual funds and stocks. One of its standout features is the lumpsum calculator—a simple but mighty tool that lets you forecast what a one-time investment could turn into.

Investing might seem tricky, but Groww’s calculator cuts through the confusion by showing how your money could grow over time. It helps you picture your future savings and match them to your personal dreams. Let’s break down how it works, why it’s a big deal, and how it guides regular people toward better money moves.

Groww Lumpsum Calculator as a Platform: Redefining Investing in India

Groww kicked off as a spot for mutual funds but grew into a full-blown investment hub, covering stocks, fixed deposits, and even U.S. shares. Its real win is the easy-to-use design and focus on teaching folks about finance.

For those who used to find investing scary, Groww makes it welcoming with a sleek app, clear steps, and helpful guides. The lumpsum calculator fits right into this—turning big financial ideas into practical tips you can use.

What is the Groww Lumpsum Calculator?

Groww’s lumpsum calculator is a built-in online feature on their platform. It helps you guess how much your one-time mutual fund splash could be worth after a set number of years.

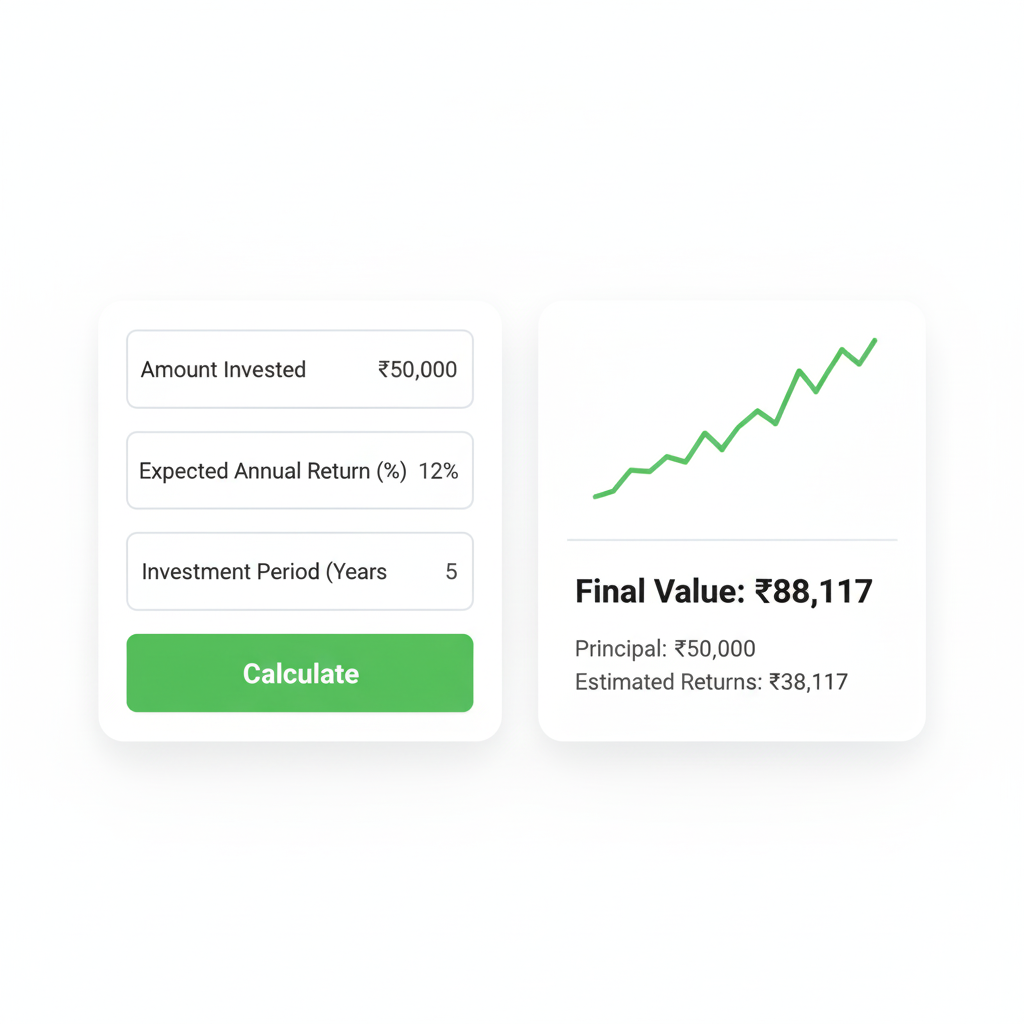

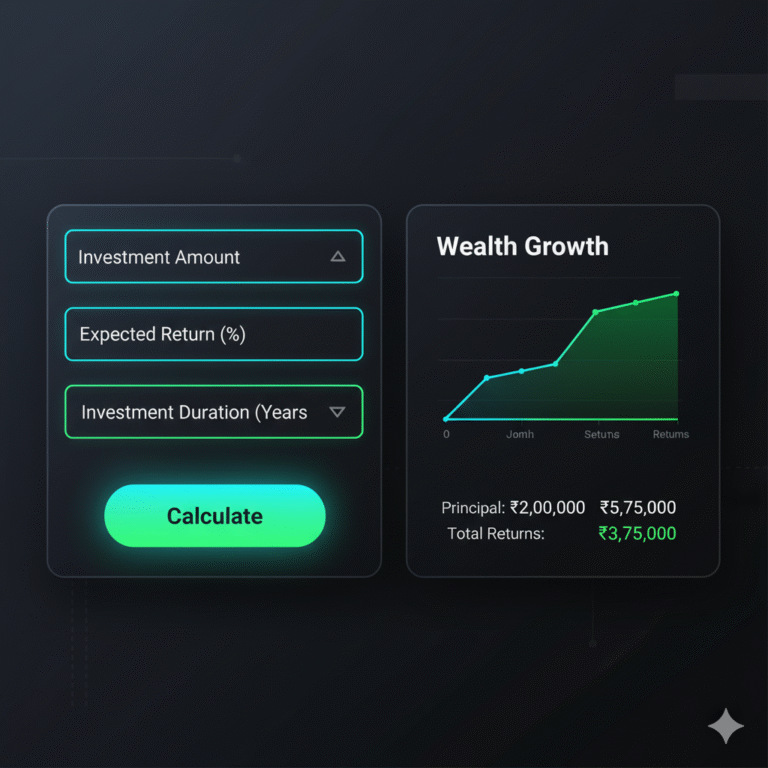

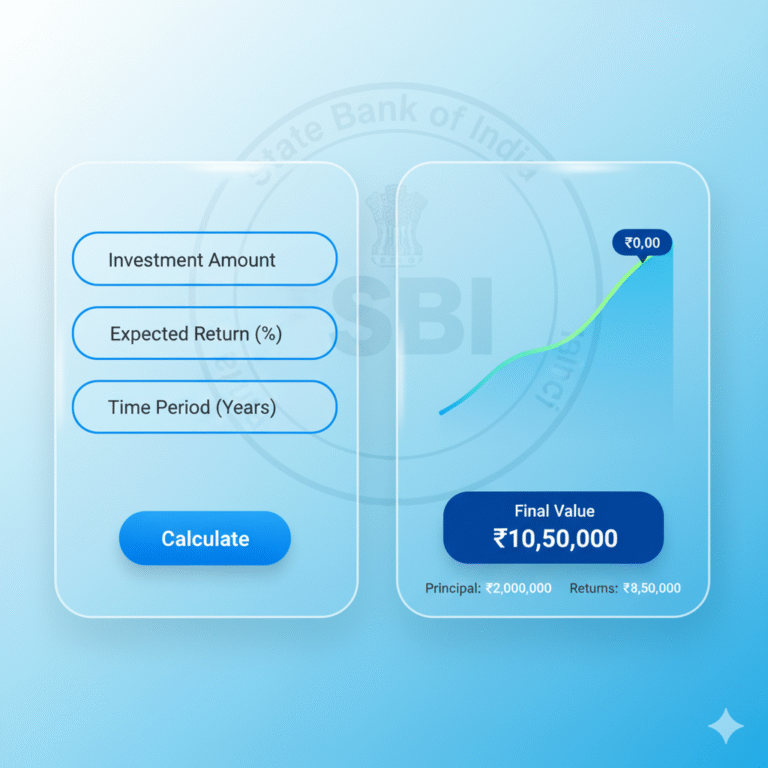

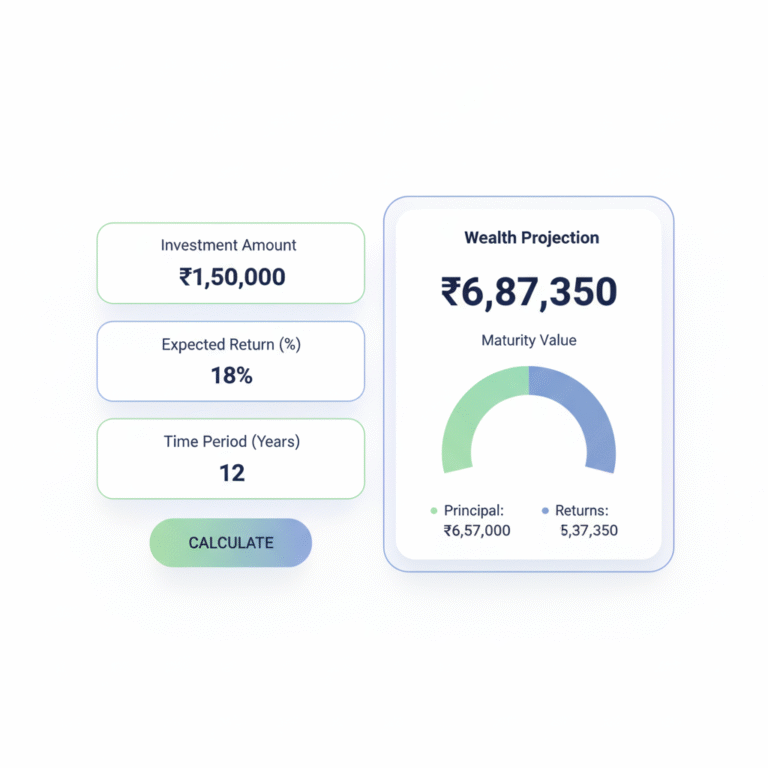

Using it is a snap: just pop in:

- The amount you’re investing all at once.

- The yearly return rate you expect.

- How many years it’ll stay invested.

It crunches the numbers and shows the projected future value in a flash. By making these forecasts so easy, Groww eases worries and boosts your confidence.

The Power of Groww Lumpsum Calculator Investments

Before we get into the calculator details, let’s chat about why lumpsum investing rocks. Unlike SIPs where you add bits regularly, lumpsum means dropping a big sum in one go.

This lets compounding work its magic on the whole amount from the start. If markets do well long-term, you could see some serious growth. Groww’s tool captures that potential and lays it out in easy-to-grasp figures.

Why Groww’s Calculator Stands Out

Plenty of calculators are floating around online, but Groww’s shines for a few key reasons:

- Tied into Groww’s world – See your projections? Jump straight to checking out mutual funds in the app.

- Super simple – Even if you’re new to this, you’ll get it without any finance background.

- Always available – Works on web or mobile, whenever you need it.

- Play around with scenarios – Tweak rates and timelines to compare options.

It’s not just a calculator—it’s a springboard to actually doing something with your money.

The Mathematics Behind the Groww Lumpsum Calculator

The results look effortless, but it’s all based on compound interest. The core formula is:

Future Value = Principal × (1 + Rate of Return) ^ Time

Groww uses this to forecast returns. Keep in mind, these are just estimates—real mutual fund results depend on the market. But they give you a solid starting point for planning.

Using the Calculator for Goal-Oriented Planning

A smart way to use Groww Lumpsum Calculator is linking it to your life goals. Don’t just plug in numbers for fun—tie them to what you want:

- Retirement prep: See what a lump sum now could grow to in 25 years.

- Kid’s education: Map out 15 years to cover college costs.

- Building wealth for fun stuff: Travel, starting a business, or upgrading your life.

It shows if you’re on track, so you can bump up the amount or time if needed to hit your targets.

Time as the Game-Changer

The calculator drives home a key investing fact: more time means more growth. Even slight timeline tweaks can lead to big differences in what you end up with.

Take ₹3,00,000 at 12% returns: Over 20 years, it could grow way more than in 10. Groww’s visuals make this obvious, encouraging you to think ahead instead of quick wins.

Lumpsum vs SIP: The Groww Lumpsum Calculator Advantage

Wondering if Groww Lumpsum Calculator beats SIP? Groww has calculators for both, so you can compare. SIPs smooth out market bumps with rupee-cost averaging, while lumpsums kick off compounding right away.

Checking side by side on Groww helps you pick what fits your style. Some folks mix it up—a lump sum from a bonus plus steady SIPs for consistency.

Inflation Awareness Through the Calculator

Skipping inflation is a common trap in planning. What costs ₹10 lakh now might hit ₹20 lakh later as prices rise. Groww’s tool shows straight growth, but you can play with lower return rates to factor in inflation indirectly.

Testing conservative setups keeps your expectations real and preps you better.

Groww’s Role in Building Investor Confidence

More than math, Groww’s calculator builds mental strength. Dropping a big sum can feel risky for newbies. The tool calms that by showing clear paths forward. Watching money multiply over time makes you bolder.

For pros, it’s a check-up on strategies. Either way, it’s a helpful guide, not just a cruncher.

Practical Examples of Using Groww Lumpsum Calculator

Picture a young pro with a ₹2,00,000 bonus. Instead of parking it in savings, they use Groww to see growth in equity funds over 15 years. The numbers look good, so they invest.

Or a family eyeing kid’s college: They check if their lump sum covers future fees. If short, the tool spots the gap for fixes.

These real-world uses turn theory into action.

Common Mistakes Avoided with Groww Lumpsum Calculator

Bad moves happen without tools like this. Groww Lumpsum Calculator helps dodge them by:

- Curbing wild dreams of huge returns without risks.

- Stressing how time builds wealth.

- Pushing patience over quick cash-outs.

- Guiding toward goals, not random investments.

Numbers help cut through emotional decisions.

Groww’s Ecosystem: Beyond the Calculator

The Groww Lumpsum Calculator tool is part of Groww’s bigger setup. After projections, browse funds, read reviews, and invest—all in one place.

Groww isn’t just a calculator; it’s your all-in-one for planning, investing, and watching your money grow.

FAQs on Groww Lumpsum Calculator

Final Thoughts

Groww’s lumpsum calculator captures their vibe: simple, open, and easy investing. It boils down tough math to friendly forecasts, helping you choose wisely.

It spotlights time, patience, and real expectations in building wealth. Paired with Groww’s full toolkit, it’s the kickoff to a smart money path.

For newbies, it’s clear guidance. For experts, it’s a solid check. In all cases, it’s more than a tool—it’s your ally for goal-driven investing.