Lump Sum Return Calculator – Check Future Value & Growth

These days, planning your finances isn’t optional—it’s a must in our fast-paced world. With living costs climbing, big life dreams, and an unpredictable future, everyone’s hunting for ways to lock down their money situation. Out of all the investment options, lump sum investments appeal to individuals who prefer making a large one-time investment instead of smaller, ongoing payments. But the big question lingers: What’ll happen to that money after years of growth?

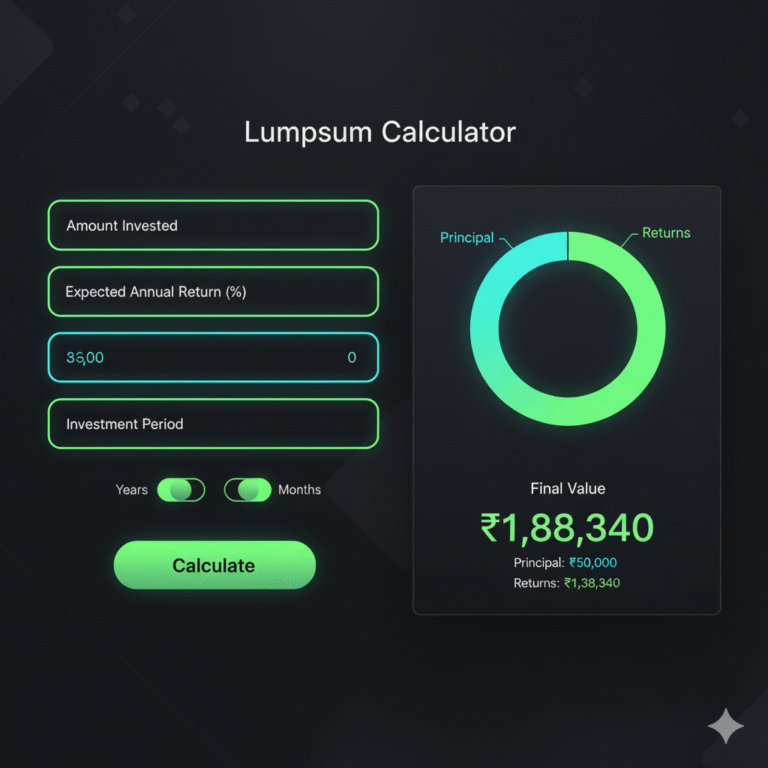

That’s where the lump sum return calculator shines. It’s a clever online tool that lets you predict what your single investment could become, helping you make smart calls before putting your cash on the line.

Understanding the Concept of a Lump Sum Investment

Before jumping into the calculator, let’s get clear on what a lump sum investment really is. It’s when you invest a hefty single amount right away, often in things like mutual funds, bonds, or fixed deposits. Unlike SIPs, which spread out smaller payments monthly, lump sum gets your money working in the market from day one, letting it compound immediately.

This approach suits people getting bonuses, inheritances, or with extra savings who want to boost returns without monthly hassles. It’s appealing, but needs good planning—and that’s why tools like this calculator are so useful.

What Exactly is a Lump Sum Return Calculator?

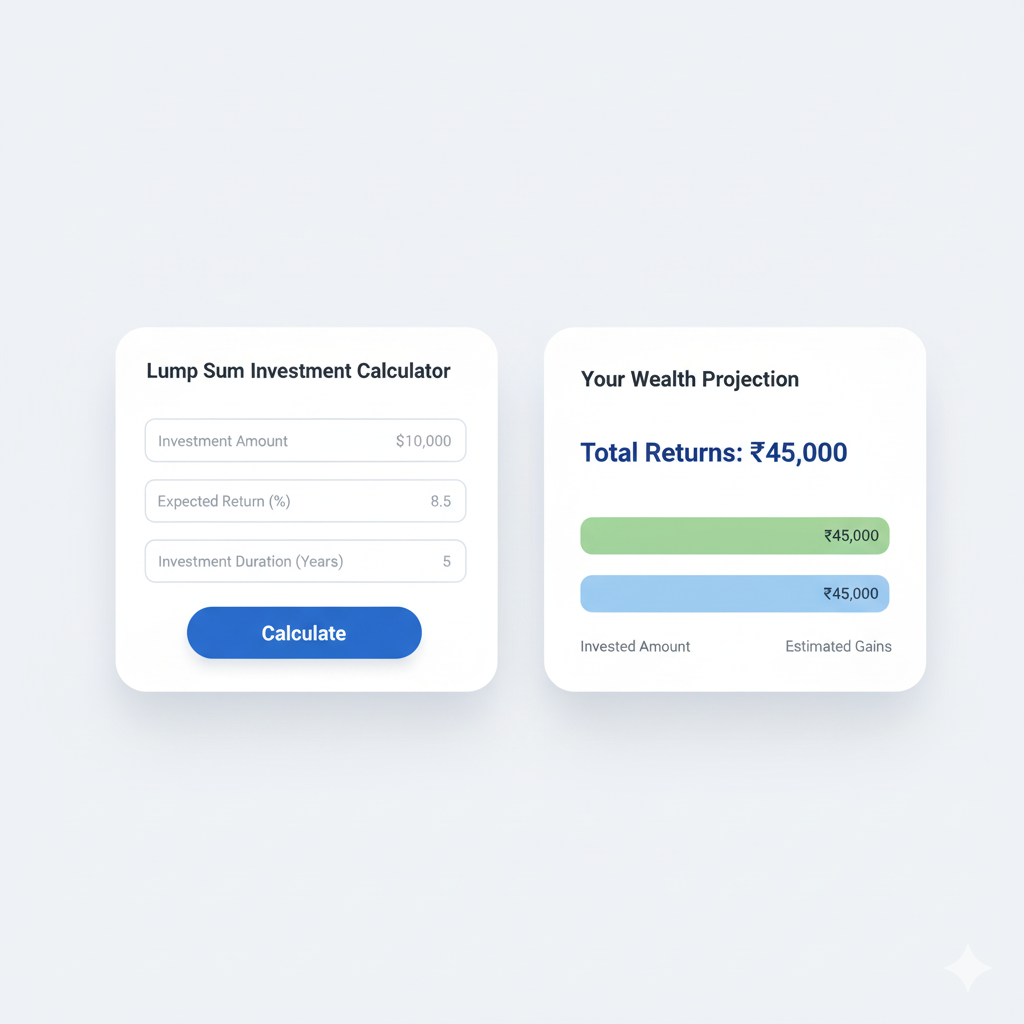

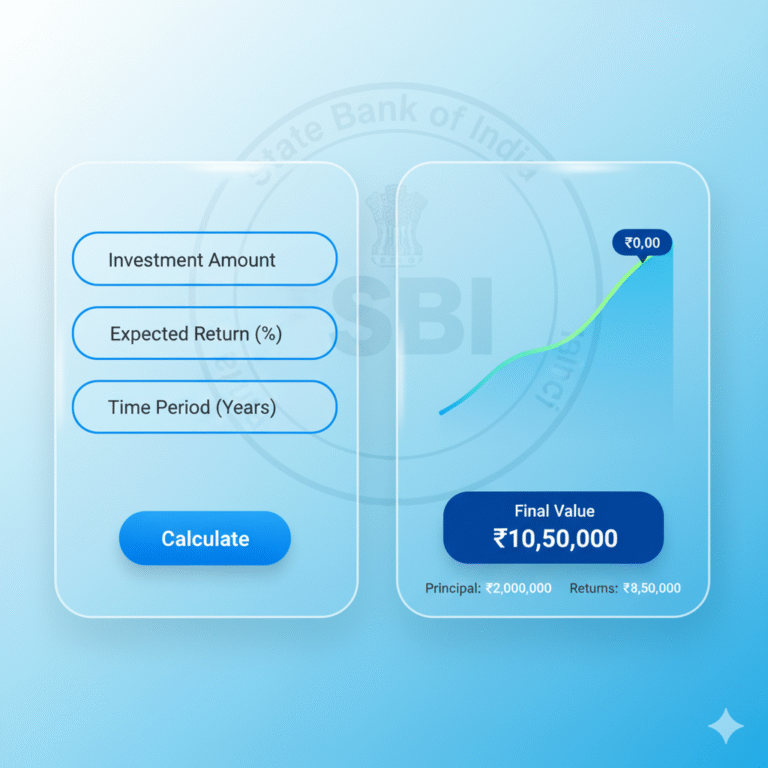

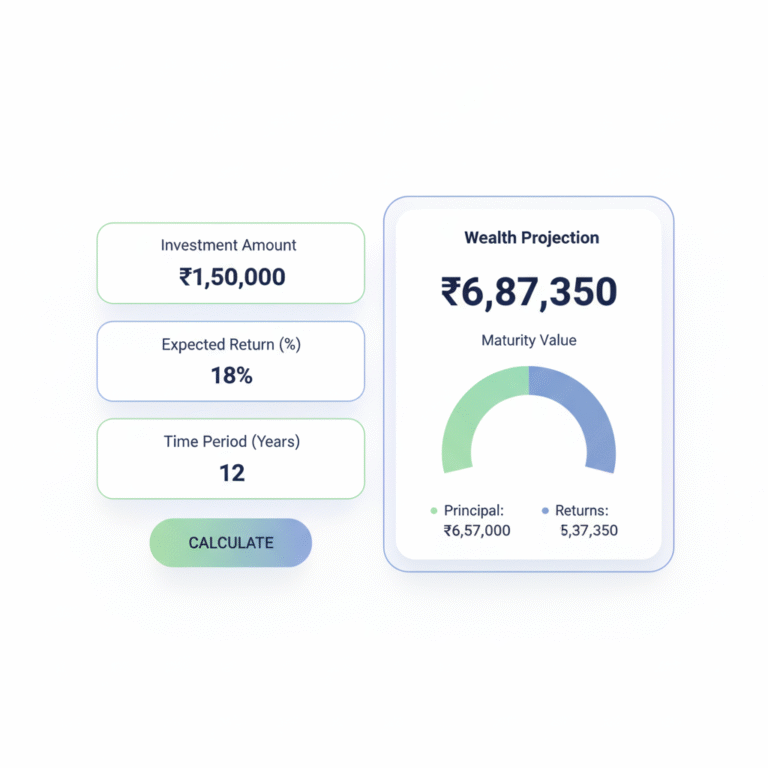

A lump sum return calculator is a web-based helper that shows how your one-time investment might grow over time. Simply input the amount, expected yearly return, and the duration of your investment, and it calculates the projected final value.

Sure, the numbers are estimates, not promises, but they offer a real sense of growth potential. For anyone nervous about a big investment, it builds confidence by letting you picture the results upfront.

The Science Behind the Calculations

The heart of the lump sum return calculator is compounding—where your initial money earns returns, and those returns earn more over time.

The basic formula is:

Future Value = Principal × (1 + Rate of Return / Compounding Frequency) ^ (Compounding Frequency × Years)

It sounds a bit mathy, but the tool does all the work. Enter three simple details, and you get a straightforward number showing potential growth.

Why Investors Depend on Lump Sum Return Calculators

Big money decisions aren’t made lightly, especially with a lot at stake. This lump sum return calculator adds ease and peace of mind. It cuts down on unknowns, clarifies possible returns, and matches expectations to real markets.

Plus, it skips human mistakes. Figuring out growth over 10, 15, or 20 years by hand can mess up easily. A digital tool keeps things accurate, avoiding over- or under-guessing.

The Role of Time in Wealth Growth

One cool thing the calculator highlights is time’s magic. A single investment now can explode in value with enough years.

Take ₹5,00,000 at 12% yearly—it grows way more in 20 years than 10. The tool shows how staying patient can lead to huge gains, pushing you to plan long-term.

This focus on time helps with goals. Parents saving for kids’ school or folks eyeing retirement can tweak timelines to fit their needs.

Comparing Lump Sum with Other Investment Styles

Lump sum has its perks, but it’s often pitted against SIPs and other regular methods. The calculator lets you see how a one-time drop compares to ongoing additions.

In a rising market, lump sum can win big since all your money compounds from the start. But in shaky or falling markets, SIPs feel safer by averaging costs over time. Testing both with calculators helps pick what fits your style.

Practical Applications of the Lump Sum Return Calculator

The lump sum return calculator isn’t just for numbers—it’s a real-life planner for different stages.

A young pro might check how today’s lump sum could buy a house in 15 years.

A mid-career person could see retirement growth from a bonus investment.

Parents can figure out funding for overseas education with one deposit now.

In every case, it turns vague ideas into concrete, goal-focused plans.

Taking Inflation into Account

Just looking at raw numbers misses inflation, which shrinks what your money can buy. Growing to ₹20,00,000 in 15 years sounds great, but at 6% yearly inflation, it’s worth less in reality.

Some advanced calculators adjust for inflation, showing true returns. This keeps your planning grounded and avoids letdowns.

How Reliable Are the Results?

Remember, the calculator’s projections aren’t set in stone. For market-tied options like mutual funds, real returns hinge on performance and conditions.

But it gives a useful starting point. Tweaking rates—like 8%, 10%, or 12%—preps you for good, average, or tough scenarios. This builds flexible plans.

Advantages of Lump Sum Investments Through the Calculator’s Lens

With the calculator, lump sum investing shows clear wins. You see compounding’s impact, enjoy the ease of one deposit, and compare fund types.

It also builds discipline. Viewing decades of growth motivates you to stay put. Basically, the tool doesn’t just compute—it teaches and inspires.

Common Missteps to Avoid

Even with calculators, some folks slip up and hurt their growth. Ignoring inflation, chasing sky-high returns, or pulling out early kills compounding.

Using the tool wisely, with real expectations and good funds, helps dodge these and lets your money thrive.

How to Make the Most of a Lump Sum Return Calculator

To really benefit, don’t use it once—keep tweaking as goals evolve. Play with times, returns, and amounts for a solid roadmap.

Stick to calculators from trusted banks or fund companies. They often add inflation tweaks, risk checks, and SIP comparisons for a fuller view.

FAQs on Lump Sum Return Calculator

Final Reflection

The lump sum return calculator is more than a digit spinner—it’s a link from dreams to real plans. It turns numbers into insights, helping you step confidently toward goals.

By revealing time’s growth power, it teaches compounding, stresses patience, and promotes smart investing. For anyone eyeing a one-time move, it brings the needed clarity.

Whether for retirement, kids’ futures, or wealth building, this tool is your easiest, strongest partner in investing.