Lumpsum Calculator Finology – Smart Way to Estimate Returns

Investing can feel pretty overwhelming when you’re not sure how your money will grow down the line. Things like mutual funds promise good returns, but the uncertainty often stops people from dumping a big chunk in all at once. That’s where Lumpsum Calculator Finology comes in handy—it’s like a reliable buddy that simplifies all that financial guesswork, letting you see the big picture before you commit your cash.

Unlike those basic calculators out there, Finology’s version is made for today’s investors who want something easy yet trustworthy. It turns those tricky compounding math problems into simple numbers, so you can picture how your one-time investment might play out over different time frames.

Understanding Lumpsum Calculator Finology Approach to Investment Tools

Finology is all about making finance stuff user-friendly, helping everyday folks get past the jargon. They’ve always focused on simplifying money management with smart digital tools, and their Lumpsum Calculator Finology is a prime example.

Instead of bombarding you with spreadsheets or complicated formulas, Finology keeps things clean and interactive. That’s why it’s a hit with newer investors who want to handle their own finances without wasting time on manual math.

What Makes the Lumpsum Calculator Finology Special

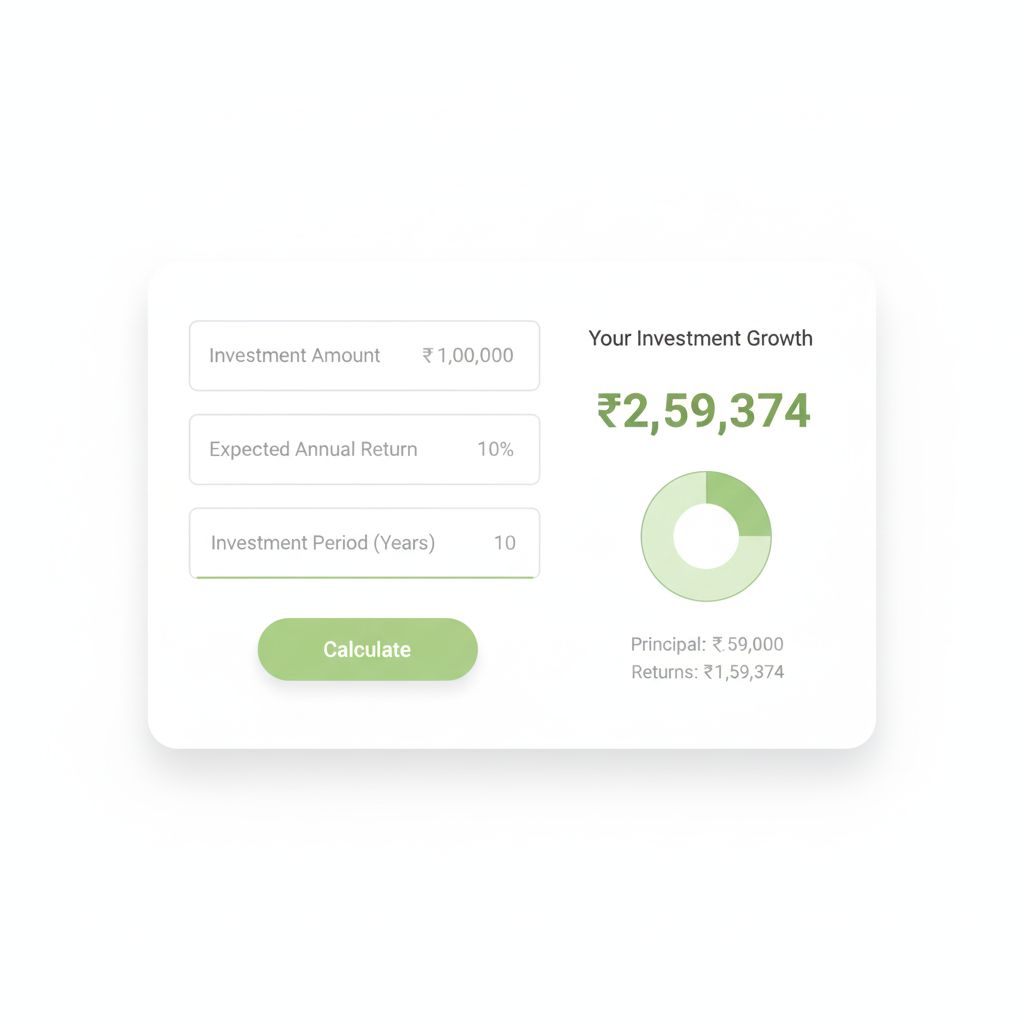

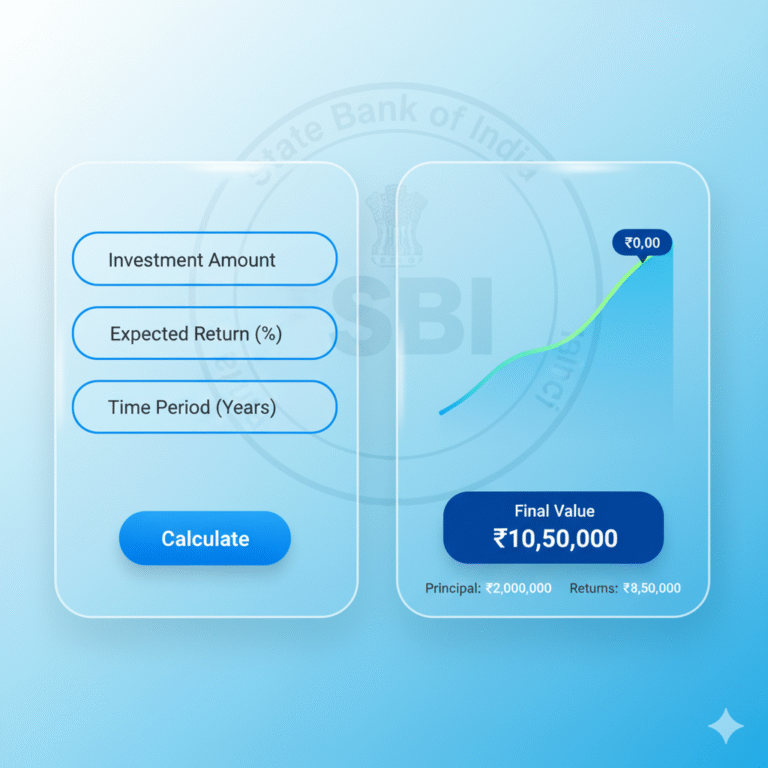

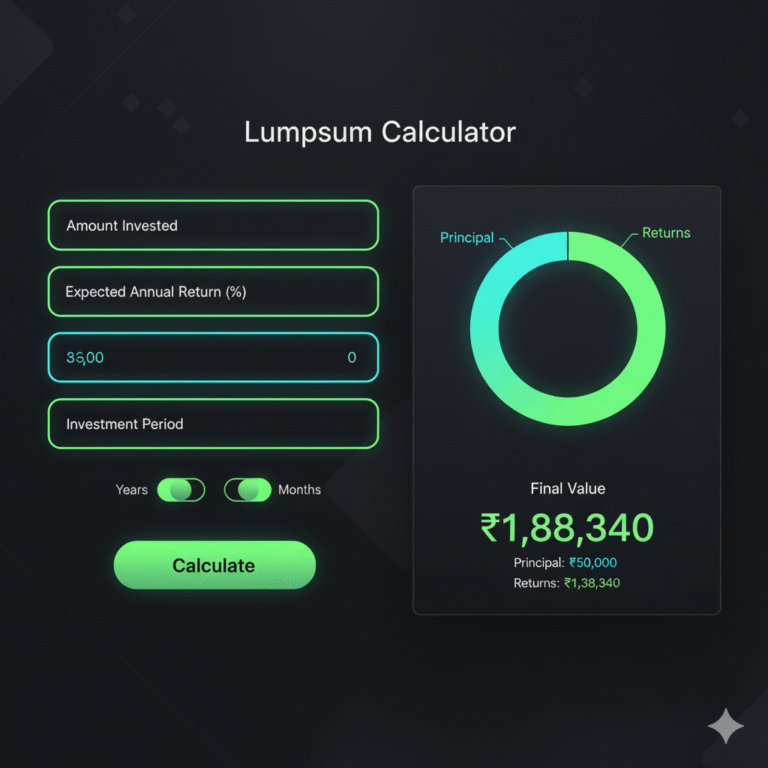

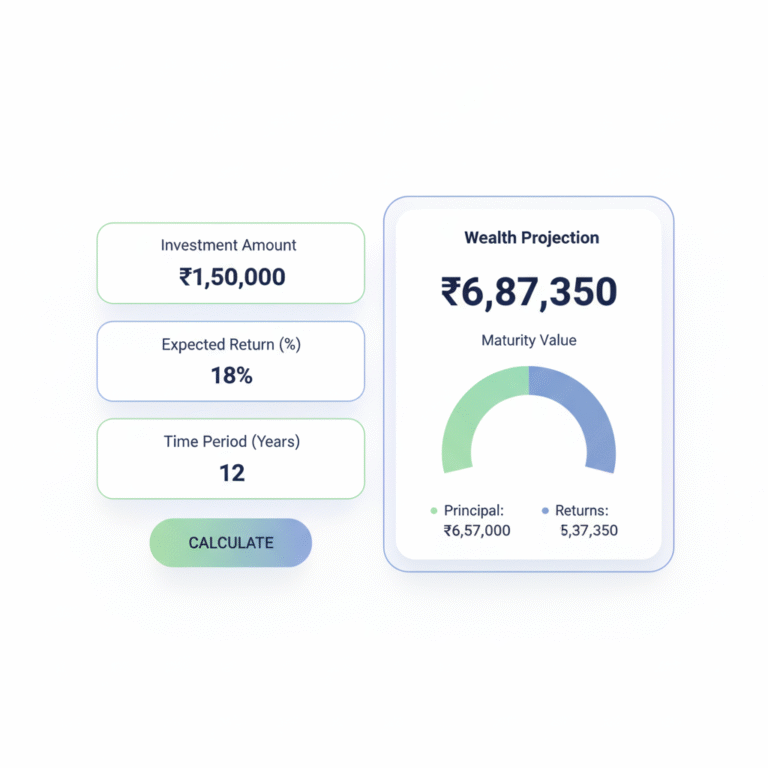

Sure, there are tons of online calculators, but Lumpsum Calculator Finology stands out for being precise and straightforward. You just plug in three key things:

- The amount you’re investing as a lump sum.

- The expected yearly return rate.

- How many years you’ll let it sit.

Boom—the tool spits out the future value right away. But it goes beyond that. Finology makes the results easy to get, tying them to real goals like saving for retirement, kids’ education, or buying a house.

The Role of Compounding in Wealth Growth

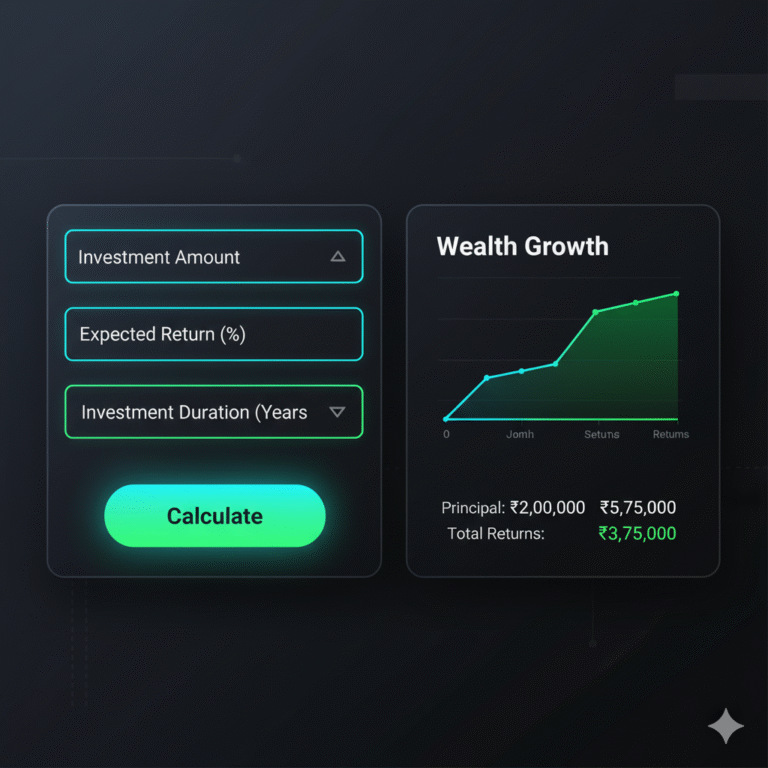

At the heart of Lumpsum Calculator Finology is compounding—that “eighth wonder of the world” where your earnings start making more earnings over time.

Take ₹2,00,000 invested at 12% a year: Over 20 years, it could grow way more than in just 10, thanks to those compounding boosts piling up. The calculator shows this clearly, helping you see why hanging in there longer leads to serious growth.

Why Investors Prefer Using Lumpsum Calculator Finology

Folks love Lumpsum Calculator Finology for a few good reasons:

- Ease of Use – No need for fancy skills; simple inputs give you quick answers.

- Time-Saving – Skip the spreadsheets and get projections in seconds.

- Realistic Forecasting – Test out conservative, moderate, or aggressive returns to prep for whatever the market throws at you.

- Accessible Anywhere – It’s online, so grab it on your computer, tablet, or phone—no apps to download.

This mix of convenience and dependability makes financial planning feel doable for everyone, from students to pros.

Practical Scenarios for Using the Lumpsum Calculator Finology

Lumpsum Calculator Finology isn’t just for crunching numbers—it’s super useful for real-life planning.

- Retirement Planning: If you’re in your 30s, see what a one-time investment could be worth by 60.

- Education Goals: Parents can figure out how a lump sum now might cover college costs later.

- Wealth Creation: Dreaming of travel, a home, or starting a business? Use it to set solid targets.

It turns vague dreams into concrete plans you can actually follow.

Comparing Lumpsum Calculator Finology with Generic Tools

Lots of sites have calculators, but Lumpsum Calculator Finology is sharper and clearer. Basic ones just give you a final number and call it a day. Finology lets you tweak things and see how changes—like a 2% drop in returns or adding 5 years—affect the outcome. It’s like having an interactive coach for your money decisions.

How Tenure Impacts Lumpsum Calculator Finology Growth in Finology’s Calculator

One big takeaway from this calculator is how time makes a huge difference. Even a little extra time can boost results big time.

Say you invest ₹5,00,000 at 10% returns: In 10 years, it might hit around ₹12,96,000. Stretch it to 20 years, and you’re looking at over ₹33,00,000. That eye-opener pushes you to start early and stay patient.

The Power of Scenario Testing in Lumpsum Calculator Finology

Finology’s tool shines when you play around with scenarios. Change the inputs and watch the results shift instantly.

- Conservative types might try 6% for tough times.

- Moderate folks could go with 10%.

- Aggressive investors test 12–14% for boom periods.

This helps set real expectations, so you’re not caught off guard by market swings.

Inflation and Real Returns: What Finology Teaches Investors

A common slip-up is forgetting inflation—today’s money won’t buy as much tomorrow.

Like, ₹20 lakh for education might work now, but in 15 years, costs could double. Finology’s calculator nudges you to think about real returns (after inflation), so you’re planning for what actually matters.

Educating Investors Beyond Numbers

Finology isn’t just about tools—they’re educators too. Their calculator fits into a bigger setup that teaches investing basics.

For beginners, it’s a wake-up call to how money grows. For veterans, it reminds you why pulling out early hurts. It’s not just numbers; it’s building smart habits.

Integrating the Calculator into Goal-Based Investing

Today’s planning is all about tying money to specific goals. Lumpsum Calculator Finology’s tool helps check if your lump sum hits the mark.

Planning a house in 12 years? See if it’s enough, then adjust until it fits. It makes your financial path feel directed and meaningful.

Why Finology Appeals to Young Investors

Younger folks often shy away from big investments due to fear. Finology’s transparency shows the possibilities, easing those worries.

Plus, the sleek interface clicks with tech-loving millennials and Gen Z. They crave control and clarity, and this delivers.

Common Mistakes the Calculator Helps Avoid

Using Lumpsum Calculator Finology’s steers you clear of pitfalls like:

- Overhyping returns and getting let down.

- Overlooking inflation in long-term plans.

- Cashing out too soon and killing compounding.

- Skipping scenario tests, leading to pie-in-the-sky dreams.

It helps craft tougher, smarter strategies.

FAQs on Lumpsum Calculator Finology

Final Thoughts

Lumpsum Calculator Finology’s is more than a gadget—it’s a confidence booster for planning. It breaks down complex math into straightforward forecasts, linking investments to your actual goals.

With tricks like scenario play, inflation smarts, and a friendly setup, it connects theory to real choices. Whether you’re new to mutual funds or plotting long-haul strategies, it’s a solid sidekick for building wealth.

By using it, you don’t just run numbers—you get clear-headed, stay disciplined, and map out your path to financial freedom.