Mutual Fund Lump Sum Calculator: Your Guide to Smarter Investment Decisions

In the investing world, mutual funds are a top pick for newbies and pros alike. With expert management, variety, and easy access, they’re great for growing your money over time. But a big worry for many is figuring out how their investment will actually grow. That’s where the mutual fund lump sum calculator comes in handy.

This tool gives you a solid idea of what a one-time investment could turn into down the road. Whether you’re saving for retirement, your kid’s school, or just building wealth, it helps you make smart choices based on facts, not hunches.

What is a Mutual Fund Lump Sum Calculator?

A mutual fund lump sum calculator is an online gadget that predicts what your single big investment in mutual funds might be worth later. Unlike SIPs, where you add money bit by bit, lump sum means dropping a chunk all at once.

Say you put ₹5,00,000 into a stock-based mutual fund today—the calculator can show you its potential value in 10, 15, or 20 years, using an expected return rate.

It won’t tell the future exactly, but it gives a practical estimate using compound interest and typical returns.

How Does a Mutual Fund Lump Sum Calculator Work?

Lump sum calculators run on compound growth. The formula is:

A = P (1 + r/n)^(nt)

Where:

A = What it’ll be worth in the end

P = The amount you start with

r = Expected yearly return (as a decimal)

n = How often it compounds yearly

t = Years invested

Plug in your amount, return expectation, and time frame, and it spits out the projected final value. Super quick, and no need for pencil-and-paper math to test different ideas.

Why is a Mutual Fund Lump Sum Calculator Important?

Getting why this tool matters helps you make better money moves. Here’s the deal:

It cuts out the guessing and shows you likely returns.

You can compare different time spans and rates.

It organizes your long-term plans.

It keeps you motivated to build wealth.

With reliable forecasts, it’s like a roadmap for anyone making a big one-time mutual fund investment.

Benefits of Using a Mutual Fund Lump Sum Calculator

This calculator offers way more than just ease. Check out the key perks:

Simplifies Complex Calculations

No more wrestling with formulas—get growth info with a few clicks.

Provides a Vision for the Future

Seeing the end value helps match your goals to the right timeline.

Helps Choose the Right Fund

Easier to weigh options like stocks, bonds, or mixes when you see potential payoffs.

Encourages Long-Term Investment Discipline

Spotting compounding’s power pushes you to hang in there and skip early cash-outs.

Free and Easily Accessible

Loads of finance sites, fund companies, and apps have free ones ready anytime.

Lump Sum vs SIP: Which Works Better?

Folks often wonder: lump sum or SIP?

Lump Sum Investment: Perfect if you’ve got a big pile of cash. Your money starts compounding from day one.

SIP Investment: Great for steady smaller additions. It lowers risk by spreading buys over time.

The lump sum calculator lets you compare how a single drop might stack up against ongoing SIPs. It boils down to your cash situation, risk comfort, and what’s happening in the market.

Key Factors That Influence Lump Sum Returns

The calculator’s output depends on a few big things:

Investment Amount

More up front means more room to grow.

Tenure of Investment

Time is king—the longer, the better for compounding.

Expected Rate of Return

Funds vary; stock ones can grow fast but risky, bond ones are steadier but slower.

Market Conditions

Mutual funds link to markets, so real returns can shift. It’s an estimate, not a lock.

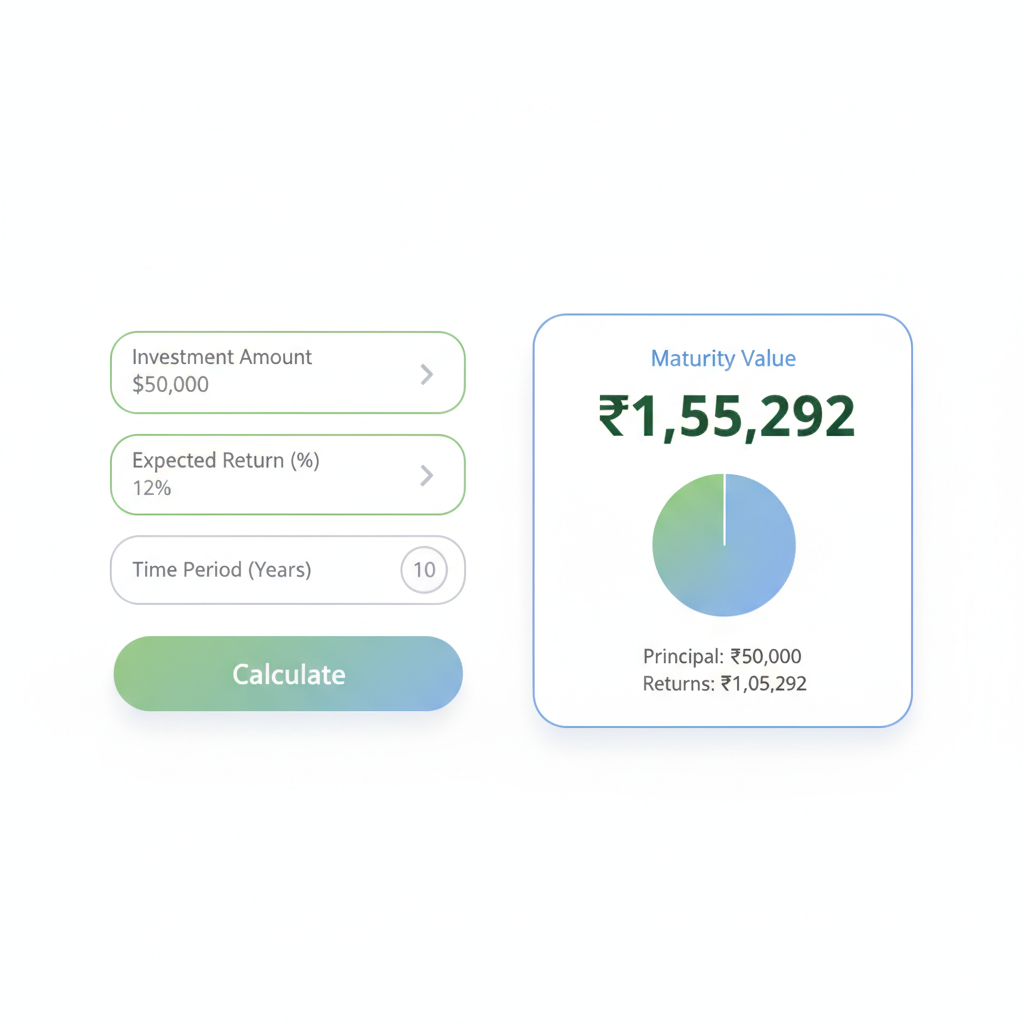

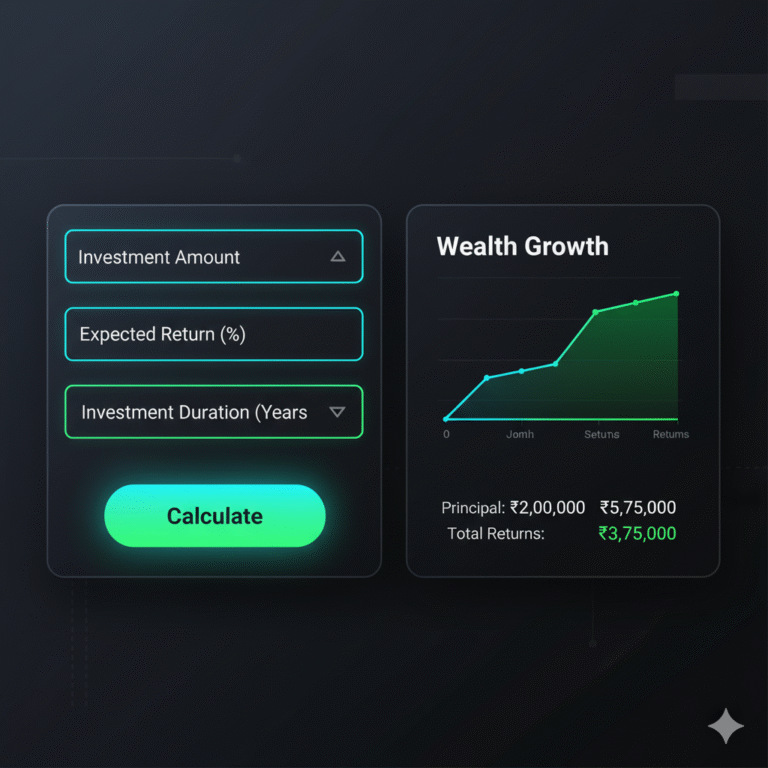

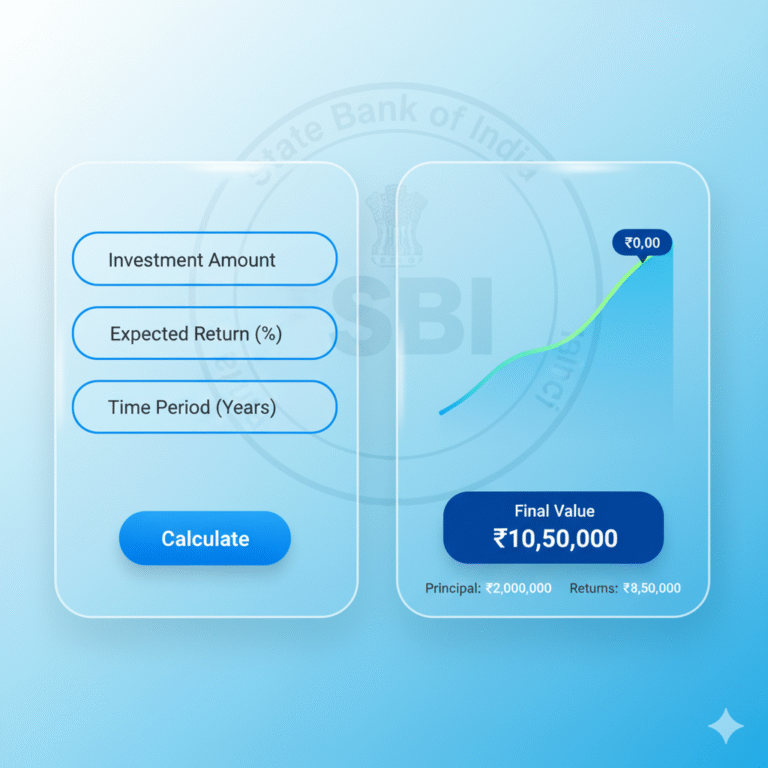

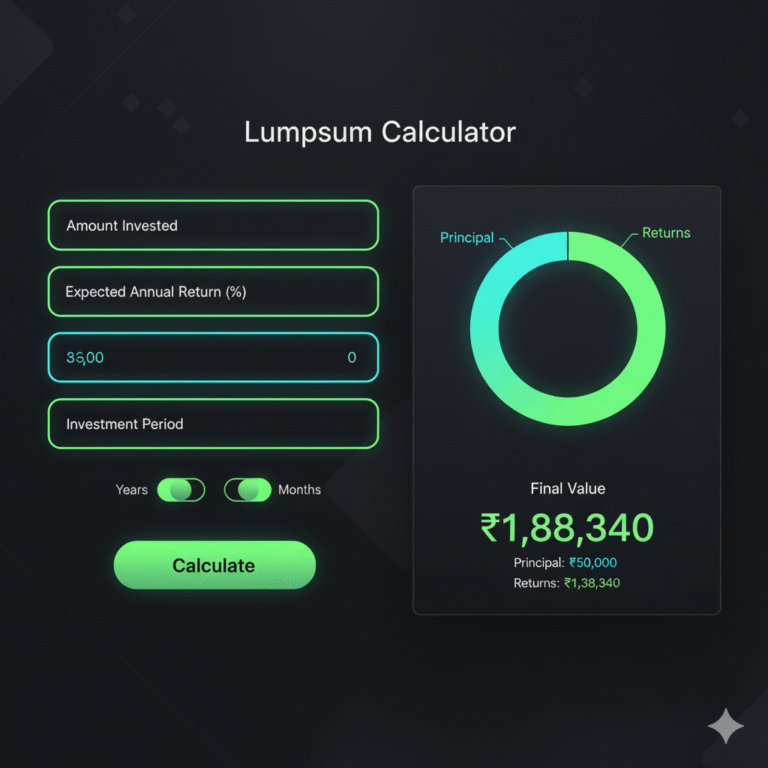

How to Use a Mutual Fund Lump Sum Calculator

It’s dead simple. Here’s how:

Go to a trusted finance site with one.

Type in your investment amount.

Add the expected yearly return (like 10-12% for stock funds).

Pick your time frame, say 10, 15, or 20 years.

Hit calculate for the projected end value.

This fast check shows if the fund fits your plans.

Mutual Fund Categories and Lump Sum Investment

Mutual funds aren’t all the same in returns. Use the calculator to compare:

Equity Funds: Risky but rewarding for long hauls.

Debt Funds: Safer, steady for shorter goals.

Hybrid Funds: Balanced for medium risk and growth.

Weighing estimates helps pick what matches your style.

Lump Sum Calculator with Inflation Adjustment

Basic ones give a future value, but fancier ones add inflation. That eats away at money’s buying power.

Like, if you hit ₹20,00,000 in 15 years but inflation’s 6% yearly, it’s worth less in real terms. Inflation-adjusted tools keep your goals grounded.

Advantages of Long-Term Lump Sum Investments

Dropping a lump sum in mutual funds has solid long-game wins:

Compounding Power: Start early, grow more.

Wealth Creation: Big investments often beat scattered ones.

Convenience: No monthly reminders like SIPs.

Goal Alignment: Suits big aims like retiring, schooling, or home buying.

With the calculator, these perks feel real and trackable.

Common Mistakes Investors Make with Mutual Fund Lump Sum Calculator Investments

Even with tools, people trip up:

Skipping inflation in plans.

Hoping for wild returns from risky funds.

Pulling out too soon.

Skipping variety and dumping all in one fund.

Dodging these keeps your investments on track.

FAQs About Mutual Fund Lump Sum Calculator

Final Thoughts

The mutual fund lump sum calculator is way more than a math helper—it’s your ally for savvy investing. It shines a light on growth potential, linking investments to your big-picture goals.

If you’ve got money just sitting there, this tool can boost your confidence to put it in mutual funds. Mix it with smart planning and real expectations, and it’s your ticket to strong, lasting finances.