SBI Lumpsum Calculator: Estimating Returns with Confidence

When it comes to dipping your toes into mutual funds or building wealth, having a clear picture is key to feeling sure about it. The State Bank of India (SBI), with its long history of reliability and branches everywhere in India, isn’t just a big bank—it’s also a top player in mutual funds. For anyone checking out investment options, the SBI lumpsum calculator is one of the easiest and most helpful tools to forecast returns.

Rather than guessing or crunching numbers by hand, this online gadget lets you see how a one-time chunk of money in SBI Mutual Funds could grow over time. With more folks in India getting into mutual funds, this calculator has turned into a favorite for newbies and pros alike.

SBI Mutual Fund and Its Growing Popularity

SBI Mutual Fund is one of India’s biggest asset managers, backed by the solid rep of the State Bank of India. Over time, it’s drawn in all kinds of investors with options like equity, debt, hybrid, and index funds.

What makes SBI stand out is how it mixes old-school reliability with modern vibes. The bank screams stability, but its mutual fund side brings cool tools like the lumpsum calculator, perfect for tech-loving investors.

The boom in mobile banking, fintech apps, and the chase for better returns has made tools like this essential for filling in those knowledge blanks.

Understanding the Concept of Lumpsum Investments

A lumpsum investment means plunking down a big amount all at once into something like a mutual fund. Unlike SIPs, where you add smaller bits every month, lumpsum gets your whole sum working with compounding from the get-go.

Take ₹5,00,000 tossed into an SBI equity fund today and held for 15 years—the full amount starts growing right away. Depending on how the market goes, you could end up with way more than you thought. The SBI lumpsum calculator breaks this down in a way that’s easy to follow.

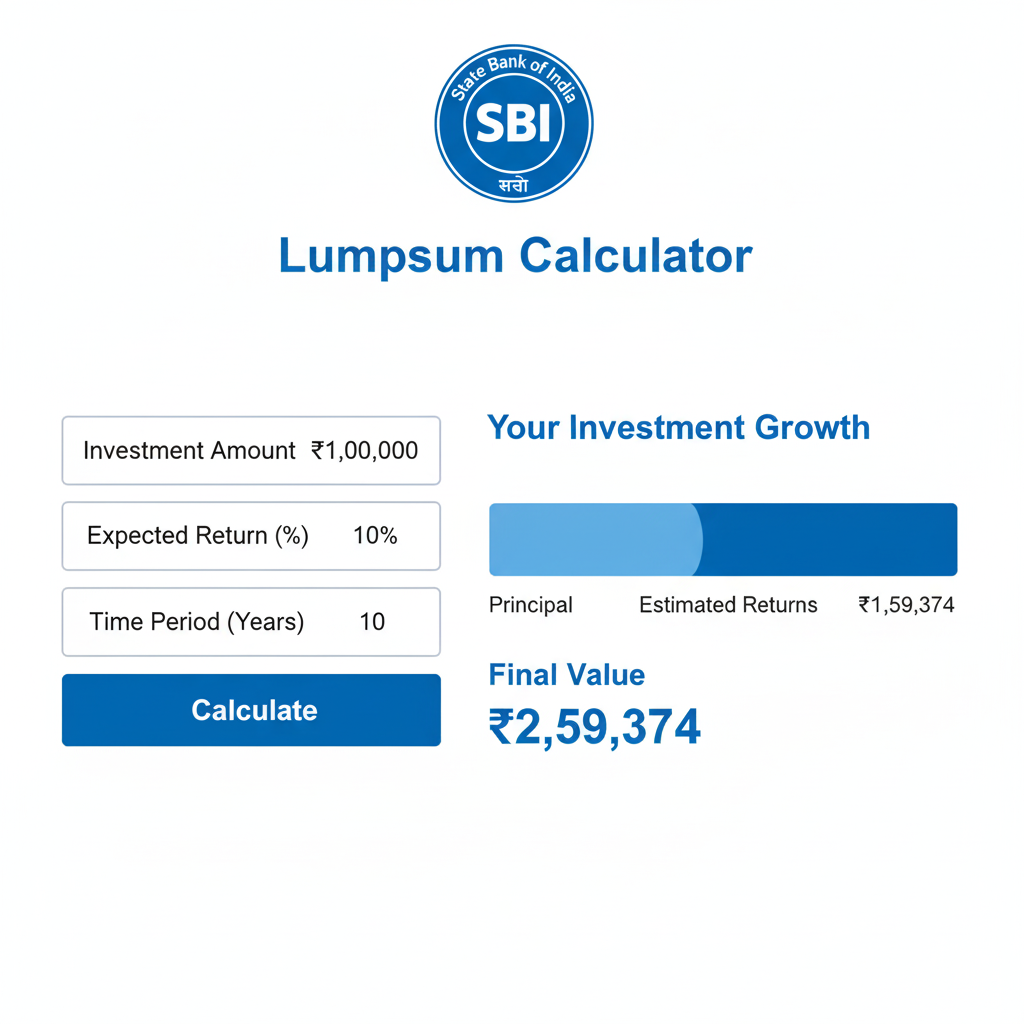

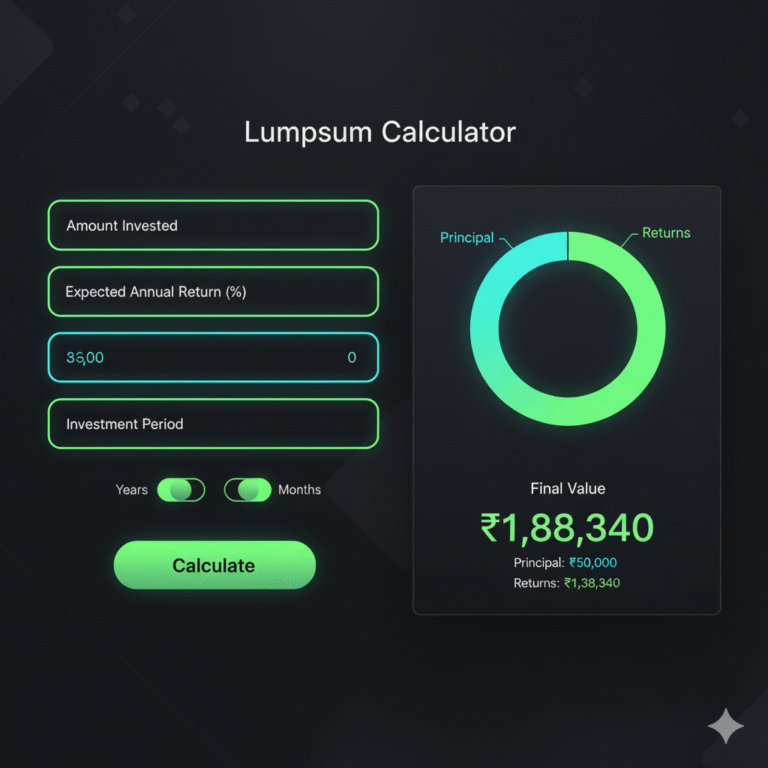

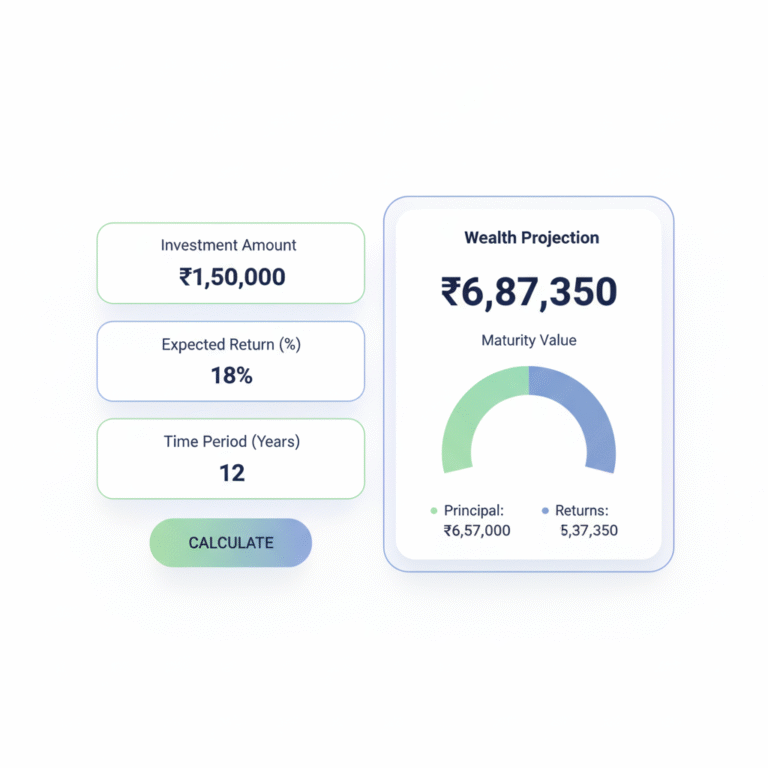

What is the SBI Lumpsum Calculator

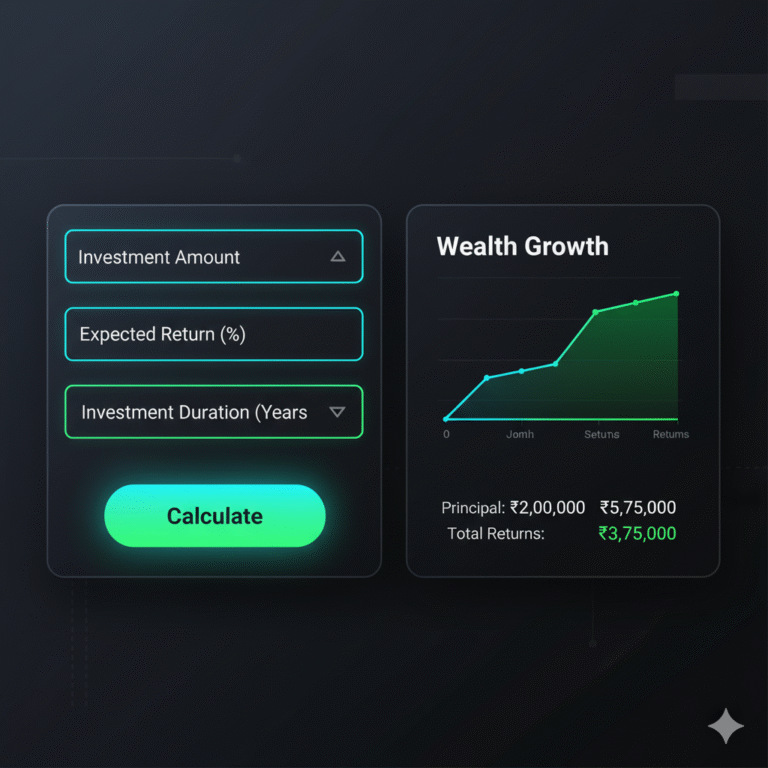

The SBI lumpsum calculator is a free online tool from SBI Mutual Fund. You just punch in:

- How much you’re investing.

- The yearly return you expect.

- How many years it’ll sit.

It then shows you the rough end value. Some spots even throw in graphs to help you picture the growth.

This keeps things straightforward, clearing up how much that single deposit might turn into over time.

The Mathematics Behind SBI’s Calculator

It looks simple, but it’s all about compound interest. The formula is:

Future Value = Principal × (1 + Rate of Return) ^ Time

Say you put in ₹2,00,000 at 12% for 10 years—it could top ₹6 lakh. The SBI tool does this math in a snap, great for folks who aren’t into formulas or Excel.

Why SBI’s Calculator Appeals to Investors

There are loads of mutual fund calculators out there, but SBI’s hits home for Indian investors because:

- Brand trust – It’s from the State Bank of India, so it feels safe and dependable.

- Made for SBI funds – Projections tie right into their schemes.

- Easy to get to – Online, no login needed, and free.

- Simple setup – Great for starters, but useful for experts too.

It wraps up clarity and reliability, making it a solid go-to.

Aligning SBI Calculator with Financial Goals

The real strength of the SBI lumpsum calculator is linking those numbers to your actual life plans. People use it to check if their investments can cover:

- Saving for retirement.

- Kids’ college costs.

- Buying a house.

- Fun stuff like trips or starting a business.

Tweak the inputs, and you can try out different what-ifs—like adding five years and watching the end amount jump.

Long-Term Wealth Creation and SBI

The tool hammers home that time is your best friend for growth. An SBI mutual fund over 20 years could explode compared to just 10.

Seeing this in the calculator pushes you to hang in there, even when markets get bumpy.

Lumpsum vs SIP in the SBI Ecosystem

Lumpsum tools focus on big one-time drops, but SBI has SIP calculators too for steady investors. Both have their place.

- SIP spreads things out, cutting down on market swing risks.

- Lumpsum jumps straight into full compounding.

Compare them on SBI’s site to pick one or mix ’em—like a bonus as lumpsum plus monthly SIPs for routine.

How Inflation Fits into SBI’s Projections

The SBI lumpsum calculator doesn’t always tweak for inflation automatically, but you can do it yourself. A ₹50 lakh goal today might need ₹1 crore in 20 years. Play with lower return rates to factor in rising prices.

This keeps you from lowballing and helps plan smarter.

Practical Example of Using SBI’s Lumpsum Calculator

Imagine Aditi, a young investor, wanting to drop ₹3,00,000 into an SBI equity fund. She plugs in 12% returns for 15 years and sees about ₹15 lakh at the end.

That visual kick gets her moving. Without it, she might’ve second-guessed or gone short-term.

It’s not just theory—it’s a push to act.

How the SBI Calculator Helps Beginners

New to investing? Terms like CAGR, NAV, or equity vs. debt can overwhelm. The SBI lumpsum calculator cuts through with just three easy inputs: amount, time, returns.

It makes starting out less scary and builds faith in the tool and SBI.

Experienced Investors and Advanced Usage

For old hands, it’s a quick gut-check. Compare SBI’s equity, debt, or hybrid by swapping return rates. Fine-tune your mix based on how much risk you’re okay with.

It’s beginner-friendly but packs punch for pros tweaking portfolios.

SBI’s Ecosystem Around the Calculator

The calculator is just the start—SBI Mutual Fund has a whole setup:

- Easy online accounts and KYC.

- Tons of fund choices.

- Dashboards to track performance.

- Learning resources for investors.

It draws you in, then supports the full ride.

SBI’s Trust Factor in Financial Planning

SBI’s lumpsum calculator gets extra love because of the bank’s street cred. For years, SBI has meant trust and safety for Indian families. That carries over to mutual funds.

Using the tool, you see numbers backed by SBI’s solidity. It eases long-term commitments without the jitters.

FAQs on SBI Lumpsum Calculator

Conclusion

The SBI lumpsum calculator is more than screen digits—it’s a link from money dreams to real steps. By making return guesses simple, it gears up new and old investors for smart picks.

SBI’s trusted name adds reassurance, so you feel good about long-haul choices. For retirement, school, or growing wealth, it helps you see ahead and move with sureness.

In a time when clear money talk matters, SBI’s tool shines for being easy, reliable, and forward-thinking. Use it to not just crunch potential savings, but match investments to life’s truths and future aims.